https://seekingalpha.com/article/4562527-ehang-stock-buy-it-now-buy-big

Summary

- Certification missed a deadline, causing a fall in share price, and management points fingers at covid lockdowns.

- In the Q3 2022 earnings call, January 2023 was given as the new date for type certification, which is at least two years ahead of the competition.

- EHang has a manufacturing site, a large order book, experience in operation, and a post-sales maintenance contract.

- I think the share price is about to surge and will benefit from a short squeeze.

This is my second article on EHang (NASDAQ:EH), the first, written in July, concentrated on debunking a short seller report and aimed to show that EH is a real company with an actual product on its way to production. Since then, shares fell to a low of $3.32, a drop of 59%, before recovering somewhat last week to a closing price of $5.73 on Friday, December 10th. I believe that EH is worth far more than this and that a surge in share value is close at hand.

What went wrong?

In July, I gave EH a per-share value of $30 and made a critical assumption that type certification would arrive in Q3 2022. This has proven not to be the case. If type certification does not come, EH has a value close to zero. Type certification is not just a safety certificate; it is a critical step without which EH does not have a business, it cannot sell its aircraft, and it cannot run its planned air mobility platform.

Since July, we have had a near total press blackout from EHang; EHang issued one press release in September saying it was moving to an in-depth stage of the certification progress and one in October talking about exploring a partnership with HAECO Group.

The lack of news, the perceived lack of progress with Type certification made worse by some of the main competitors extending their timelines, and the ongoing doubt caused by the short seller report have ensured that EHang shares followed the rest of the evtol makers lower.

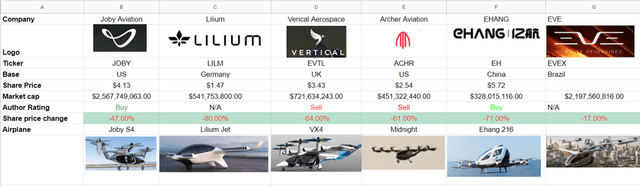

Evtol Companies (Author Database output)

It has been a challenging year for investors in this area, my investments in EH and JOBY are down a lot, but at least I avoided Archer Aviation (ACHR) and Vertical Aerospace (EVTL).

In the recent Q3 earnings call, we found out why everything appears to have ground to a halt.

Fang Xin, Chief operating officer, said in his opening remarks:

…COVID-19 resurgence and pandemic control measures in China bring considerable challenges to our original airworthiness certification process.

Richard Liu, Chief financial officer, expanded in answer to a question from a Chinese analyst when he said

Type Certification …, was originally scheduled to complete by December this year.

However, the recent epidemic resurgence in Guangzhou made it difficult for all the members across the country to come together

Due to covid restrictions, CAAC (the Chinese aviation authority) could not travel to the EHang offices in Guangzhou, one of the cities in lockdown. As a result, the final certification process could not proceed.

China is currently facing near-record levels of covid infection among its citizens and has started to implement its zero covid containment measures. There is substantial evidence that the original covid vaccine (more than 89% of the population has had two doses) is not a good defense against the now dominant omicron. However, there are equally large amounts of evidence that China is changing its stance on the zero covid policy in the face of unprecedented protests by its population.

Guangzhou is one of the many cities in China that has reduced its level of response. Indeed on November 30th, 11 districts in Guangzhou and 24 in Shanghai were released from Lockdown measures despite reporting high infection rates.

After discussing the recent changes to covid policy, Mr. Liu said

COVID restriction measures have begun to ease by steps in China. So our expectation may be around January next year.

Type certification in January 2023 is more than two years ahead of Joby Aviation, whom I believe is likely next in line, and five years ahead of Wisk Aero, the only other company I follow pursuing crewless aircraft.

After Type Certification

If EHang does get the 216 certified in January, what can we expect the business to look like?

China’s certification plans are advanced, primarily due to EHang, who have flown over 30,000 times, far more than all of their competitors. In September this year, CAAC attended the International Civil Aviation Organisation Assembly in Canada, where they shared their airworthiness standard and certification process for unmanned aircraft, likely to be a reference point when other authorities need similar regulations.

As part of the authorization process, China has designated 20 cities (up from 13 last time I wrote) as experimental zones to test these rules and regulations. EHang is seeing strong demand in these areas and is already flying in most of them. So far, they have completed 6,800 operational flights in 15 locations, including major cities like Shanghai and tourist destinations like the great wall. EHang is already active thanks to the CAAC and has built demand in these densely populated areas.

In Q3, EHang received 210 pre-orders from customers across Asia and has more than 1,200 orders already booked.

EHang is preparing for launch. In the earnings call, we learned that the discussions with the HAECO Group have resulted in a partnership to provide maintenance and training services across Asia.

When certification arrives, EHang will have 15 operational sites, and 20 cities already have the infrastructure and regulations for operations.

EHang has a full-scale manufacturing operation (please see the first article for a discussion of the manufacturing site) and has sold and delivered more than 100 of its EH-216 aircraft. The average selling price appears to be $287,000 per unit (that does not consider exchange rate fluctuations, just reported deliveries and revenue for 2021-2022).

Solving cogs equations gives direct material costs of $75,000 per aircraft. (View as approximate as I do not know the exact charges that EH are putting into cogs and have assumed a linear relationship between fixed and variable costs) fixed costs per aircraft (wages etc.) of around $100,000 with a contribution to net income of approximately $112,000 per aircraft.

In the latest reports, EHang reported $11.2 million in inventory, likely to be a mix of finished aircraft and those in production but might equate to enough stock for 150 aircraft using my figures derived from cogs. In the 2021 annual report, EHang stated that the capacity of the Yunfu manufacturing site (which opened in June of that year) was 600 units.

It would appear that EHang has the manufacturing capacity, inventory, orders, and maintenance contracts to hit an annual revenue of $172 million with a gross profit of around $104 million.

(I am rebuilding 3-statement model shown in the first article with the new information, but it is not yet complete.)

Current operating costs are running around $44 million a year. Using the information regarding the new head office in the recent earnings call, I estimate net earnings per year of $24.5 million.

The current average P/E ratio of the aerospace industry is 35.

EHang has 57.2 million shares outstanding, with a P/E of 35 and earnings of $24.5 million EHang shares should be worth $15. I think this price is on the immediate horizon.

Short Interest

Short interest in EHang stands at 20%, which is very high, and many of those short sellers are looking at a significant paper profit.

Suppose EHang receives type certification in January, as they have suggested, and aircraft start rolling out of the factory and into the skies around China. In that case, the share price will move higher quickly.

A short squeeze will fuel that rise as the short sellers cover their positions to make a healthy profit.

Conclusion

EHang aircraft and its share price are ready for takeoff; type certification is due in January 2023.

The share price seems to be well below its true value thanks to a short seller report and covid lockdowns in China. A 300% rise in short order is quite possible.

Of course, if type certification is delayed, the price will not recover.

A short squeeze might fuel any rise as the short sellers cover their positions to make a healthy profit.

I have taken a large position in EHang, my largest of 2022. I took a derivative position on the IG Markets platform and added to my stock holding.

I intend to hold the derivative position for the next 3 to 6 months and the stock positions for 1 to 2 years.

沒有留言:

張貼留言