(Reuters) - Wall Street’s most controversial stock may be about to go mainstream.

Tesla Inc appears on the verge of joining the S&P 500, a major accomplishment for Chief Executive Officer Elon Musk that would unleash a flood of new demand for the electric car maker’s shares, which have already surged 500% over the past year.

Higher-than-expected second-quarter vehicle deliveries, announced last week, have analysts increasingly confident the company will show a profit in its quarterly report on July 22. That would mark Tesla’s first cumulative four-quarter profit, a key hurdle to be added to the S&P 500.

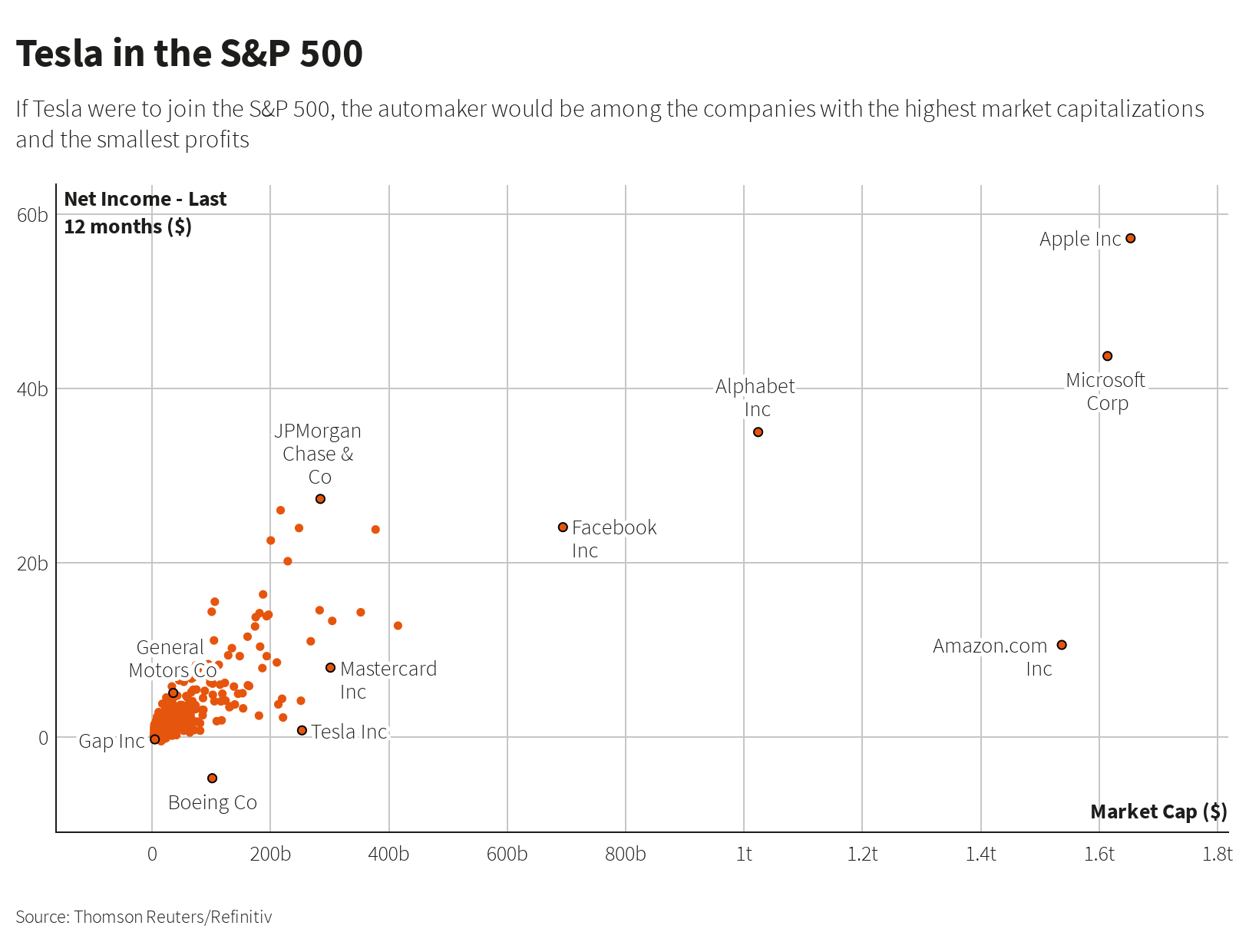

With a market capitalization of about $250 billion, Tesla would be among the most valuable companies ever added to the S&P 500, larger than 95% of the index’s existing components. It would have a major impact on investment funds that track the index.

For a graphic on Tesla potentially in the S&P 500: here

While analysts and investors have recently become more confident of Tesla’s addition, an S&P Dow Jones spokeswoman declined to comment about specific changes to the index.

Howard Silverblatt, a senior index analyst at S&P Dow Jones, had to look back to the dot-com era to recall a comparable situation. In 1999, Yahoo surged 64% in five trading days between the announcement that it would be added to the index on Nov. 30 and its inclusion after the close of trading on Dec. 7. Yahoo’s market capitalization at the time was about $56 billion.

For a graphic on Yahoo's 1999 S&P 500 debut: tmsnrt.rs/3iOlA8o

“The lesson learned from Yahoo was that when you have an up and coming issue that may possibly go into the index, you should already own a little of it,” said Silverblatt. “If you had to get into that stock, you were paying a heck of a premium compared to owning it a week earlier.”

Funds that attempt to identically track the S&P 500 have at least $4.4 trillion of assets, according to S&P Dow Jones, and those funds would need to buy Tesla shares quickly to avoid errors tracking the index’s performance.

Ivan Cajic, head of index & ETF research at Virtu Financial estimates index managers would need to own roughly 25 million shares of Tesla stock, currently worth $34 billion.

“You

have all the index funds that have no choice but to include it,” said

Tim Ghriskey, chief investment strategist at Inverness Counsel in New

York. “That is one reason why it has been so strong here, in

anticipation of that.”

Additionally, actively managed investment funds that benchmark their performance to the S&P 500 will be forced to decide whether to buy Tesla shares. Such funds manage trillions of dollars in additional assets.

“Even if you don’t like Tesla and you think it’s overvalued, the fact that it is going into the index would mean trillions of dollars would have some kind of position,” said Jim Bianco, head of Bianco Research in Chicago. “As part of their benchmark, portfolio managers would not be able to ignore it.”

Up 43% in just the past eight sessions, Tesla is among the most loved - and hated - stocks on Wall Street. It is the U.S. stock market’s purest play bet on the rise of renewable energy and the decline of fossil fuels, and Tesla’s Model 3 sedan has made major inroads among consumers.

However,

short sellers are betting $19 billion that Tesla’s shares will fall,

the largest short level on record for a U.S. company, in dollars,

according to S3 Partners.

Bears point to looming competition from Porsche, General Motors and other longer-established rivals. They are also skeptical of Tesla’s corporate governance under Musk, who in 2018 agreed to pay $20 million and step down as chairman to settle fraud charges.

Traders betting Tesla could be added to the S&P 500 have almost certainly contributed to the recent rally. However, Bianco warned that the stock could reverse if Tesla is not added to the S&P 500.

Tesla Inc appears on the verge of joining the S&P 500, a major accomplishment for Chief Executive Officer Elon Musk that would unleash a flood of new demand for the electric car maker’s shares, which have already surged 500% over the past year.

Higher-than-expected second-quarter vehicle deliveries, announced last week, have analysts increasingly confident the company will show a profit in its quarterly report on July 22. That would mark Tesla’s first cumulative four-quarter profit, a key hurdle to be added to the S&P 500.

With a market capitalization of about $250 billion, Tesla would be among the most valuable companies ever added to the S&P 500, larger than 95% of the index’s existing components. It would have a major impact on investment funds that track the index.

While analysts and investors have recently become more confident of Tesla’s addition, an S&P Dow Jones spokeswoman declined to comment about specific changes to the index.

Howard Silverblatt, a senior index analyst at S&P Dow Jones, had to look back to the dot-com era to recall a comparable situation. In 1999, Yahoo surged 64% in five trading days between the announcement that it would be added to the index on Nov. 30 and its inclusion after the close of trading on Dec. 7. Yahoo’s market capitalization at the time was about $56 billion.

FILE PHOTO: Tesla electric vehicles for test driving are parked in Hanam, South Korea, July 6, 2020. REUTERS/Kim Hong-Ji

“The lesson learned from Yahoo was that when you have an up and coming issue that may possibly go into the index, you should already own a little of it,” said Silverblatt. “If you had to get into that stock, you were paying a heck of a premium compared to owning it a week earlier.”

Funds that attempt to identically track the S&P 500 have at least $4.4 trillion of assets, according to S&P Dow Jones, and those funds would need to buy Tesla shares quickly to avoid errors tracking the index’s performance.

Ivan Cajic, head of index & ETF research at Virtu Financial estimates index managers would need to own roughly 25 million shares of Tesla stock, currently worth $34 billion.

Additionally, actively managed investment funds that benchmark their performance to the S&P 500 will be forced to decide whether to buy Tesla shares. Such funds manage trillions of dollars in additional assets.

“Even if you don’t like Tesla and you think it’s overvalued, the fact that it is going into the index would mean trillions of dollars would have some kind of position,” said Jim Bianco, head of Bianco Research in Chicago. “As part of their benchmark, portfolio managers would not be able to ignore it.”

Up 43% in just the past eight sessions, Tesla is among the most loved - and hated - stocks on Wall Street. It is the U.S. stock market’s purest play bet on the rise of renewable energy and the decline of fossil fuels, and Tesla’s Model 3 sedan has made major inroads among consumers.

FILE

PHOTO: Tesla Inc Chief Executive Officer Elon Musk is seen on a screen

during a video message at the opening ceremony of the World Artificial

Intelligence Conference (WAIC) in Shanghai, China July 9, 2020.

REUTERS/Aly Song

Bears point to looming competition from Porsche, General Motors and other longer-established rivals. They are also skeptical of Tesla’s corporate governance under Musk, who in 2018 agreed to pay $20 million and step down as chairman to settle fraud charges.

Traders betting Tesla could be added to the S&P 500 have almost certainly contributed to the recent rally. However, Bianco warned that the stock could reverse if Tesla is not added to the S&P 500.

Reporting by Noel Randewich and Chuck Mikolajczak; Editing by Alden Bentley and Marguerita Choy

*************************************************************

谷歌翻譯:

(路透社)-華爾街最具爭議的股票可能即將成為主流。

特斯拉(Tesla Inc)似乎即將加入標準普爾500指數(S&P 500),這對首席執行官埃隆·馬斯克(Elon Musk)而言是一項重大成就,這將釋放出對該電動汽車製造商股票的大量新需求,在過去一年中,這家電動汽車製造商的股價已飆升500%。

上周宣布的第二季度車輛交付量高於預期,使分析師越來越有信心該公司將在7月22日的季度報告中顯示利潤。這將標誌著特斯拉第四個季度的首次累積利潤,這是要增加的一個主要障礙。標準普爾500指數。

特斯拉的市值約為2500億美元,將成為標普500指數中市值最高的公司之一,超過該指數現有成分的95%。這將對追踪該指數的投資基金產生重大影響。

儘管分析師和投資者最近對特斯拉的加入更加有信心,但標普道瓊斯指數的女發言人拒絕評論該指數的具體變化。

標普道瓊斯(S&P Dow Jones)高級指數分析師霍華德·西爾弗布拉特(Howard Silverblatt)必須回顧網絡時代,以回想起類似的情況。1999年,雅虎在11月30日宣布加入該指數與12月7日交易收盤後的五個交易日中,股價飆升64%。雅虎當時的市值約為560億美元。

Silverblatt說:“從Yahoo中學到的教訓是,當您遇到一個可能出現在索引中的問題時,您應該已經擁有了其中的一小部分。” “如果您必須買進那隻股票,與一周前擁有它相比,您要付出高昂的溢價。”

標準普爾道瓊斯(S&P Dow Jones)稱,試圖同樣追踪標準普爾500指數的基金至少擁有4.4萬億美元的資產,而這些基金將需要迅速購買特斯拉股票,以免出現追踪該指數表現的錯誤。

Virtu Financial的指數和ETF研究負責人Ivan Cajic估計,指數經理需要擁有大約2500萬股特斯拉股票,目前價值340億美元。

紐約因弗內斯律師事務所首席投資策略師蒂姆•格里斯基(Tim Ghriskey)表示:“您擁有的所有指數基金別無選擇,只能將其包括在內。” “這就是為什麼它在這裡如此強大的原因之一,因此對此有所期待。”

此外,根據標準普爾500指數表現基準的積極管理的投資基金將被迫決定是否購買特斯拉股票。這些基金管理著數万億美元的額外資產。

“即使您不喜歡特斯拉,並且認為它被高估了,但事實上,將其納入該指數將意味著數万億美元將具有某種地位,”芝加哥Bianco Research主管吉姆·比安科(Jim Bianco)說。“作為基準測試的一部分,投資組合經理將無法忽略它。”

在過去的八個交易日中,特斯拉上漲了43%,是華爾街最受歡迎和最討厭的股票之一。這是美國股市對可再生能源的興起和化石燃料的下降最純粹的賭注,而特斯拉的Model 3轎車已在消費者中大舉入侵。

然而,根據S3 Partners的數據,賣空者押注190億美元的特斯拉股票將下跌,這是美國公司有記錄以來的最大空頭水平。

空頭指出,來自保時捷,通用汽車和其他歷史悠久的競爭對手的競爭日益迫在眉睫。他們還對馬斯克領導下的特斯拉公司治理持懷疑態度。馬斯克在2018年同意支付2000萬美元並辭去董事長職務,以解決欺詐指控。

交易員押注特斯拉可以加入標準普爾500指數,這幾乎肯定對最近的反彈起到了推動作用。但是,比安科警告說,如果不將特斯拉加入標準普爾500指數,該股可能會反轉。

Noel Randewich和Chuck Mikolajczak的報導;Alden Bentley和Marguerita Choy的編輯

我們的標準:湯森路透信託原則。

沒有留言:

張貼留言