https://seekingalpha.com/article/4459614-ehang-looking-at-the-big-picture

Summary

- EHang's price has fallen substantially in the last few months due to a poorly performing Chinese stock market as well as a sudden strategy shift that caused revenue to decline.

- The company recently decided to change its strategy from being an OEM to providing air taxi services to generate high margin recurring revenue.

- In addition, the company unveiled the VT-30, making it one of the few eVTOL companies to have more than 1 model ready for flight.

- With several eVTOL companies with much higher risk coming public through SPAC at billion dollar valuations, I think EH should be worth far more than its current valuation.

aerogondo/iStock via Getty Images

It has been around a year since I bought my first share of EHang (EH), and so much has changed since then. Execution has been disappointing, to say the least, especially considering it has been the target of a short-seller report. First, the company gave really disappointing yearly guidance for 2021 because they suddenly changed their strategy to become a platform operator instead of a vehicle OEM. Next, they announced that they would file their 20-F late, making many investors question whether their accounting had issues. Lastly, the whole Chinese market has slumped in recent months due to fears surrounding government regulations.

That being said, the company has managed to accomplish significant milestones, such as the unveiling of its VT-30 long-range eVTOL, the operational start of the Yunfu factory, and continued expansion into new countries. The company has fallen way too far from its highs and the current valuation doesn't make sense considering EH's first-mover advantage and comparably low valuations compared to other public UAM companies.

Strategy shift

Since its founding, EH has mainly generated revenue by selling eVTOLs to companies around the world. While the company could garner ASPs of around $300K per vehicle, with generous gross margins, management recently decided to shift gears to focus on becoming a UAM platform operator.

Source: EHang investor presentation

Recently, EH unveiled its 100 Air Mobility Routes Initiative, with the company targeting the implementation of 100 Chinese air mobility routes within 2 years for island hopping, low altitude aerial tourism, and suburban transportation. When these routes start functioning, it will mark the start of the company's transition from being an OEM to an air taxi service.

EH has already screened and tested 7 spots for UAV operations, mostly in South China, and has targeted another 15 operation spots. The company has also partnered with customers to conduct operations in another 21 spots. All in all, the plan seems to be moving along fast even though it only started to be implemented this year.

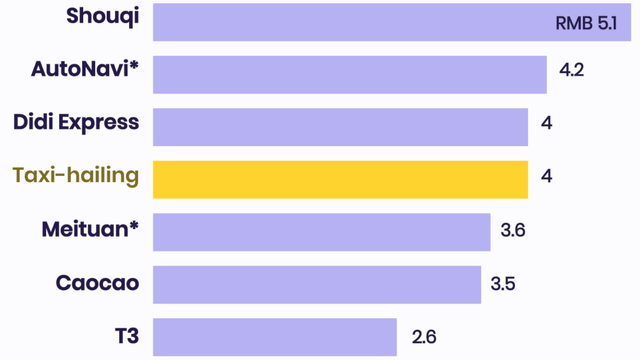

EH's published white paper should give a general idea of how this air taxi service will work. EH will likely charge a rate of around RMB 10-12 per km, or around 2-3x the price of ride-hailing competitors, allowing each eVTOL to generate an estimated RMB 2.5mil per year in revenue. The higher cost per km is offset by the fact that EH's eVTOL will likely travel in a straight line compared to the longer routes taxis usually have to take.

After deducting costs such as electricity, depreciation, etc., EH is expected to generate operating margins from 35-40%. In the whitepaper, the EH have stated that the projections are conservative and margins will increase as the cost of batteries continues to decline.

Assuming there is just 1 eVTOL deployed to each route, EH would be able to generate RMB 250mil per year in revenue, which already exceeds the record RMB 180mil in revenue generated in 2020. If EH hits its timelines as expected, revenue should be able to exceed 2020 levels once again by 2023-2024.

VT-30 unveiling

In May 2021, EH unveiled the long-range VT-30 model which is able to travel 300km with flight time of up to 100 minutes. This is a 7x increase in range compared to the previous EH 216 model with 43 miles of range and beats out other big competitors such as Joby and Lilium with around 240 miles of range.

This is a 2 person aircraft, so it isn't directly comparable to Joby and Lilium, but the immense range, and the fact that EH now has 2 completely different eVTOL designs ready to fly, is absolutely a game-changer for the industry, giving the company massive flexibility in creating its eVTOL network.

For companies such as Joby and Lilium which operate very long-range eVTOLs with passenger capacity of 5-7 people, it might be hard to find profitable demand for short-haul flights within a city, forcing the companies to only offer flights between large cities. However, for a company such as EH with 2 different models, it would be possible to offer both intracity and intercity flights, opening up a far larger market for the company.

Regulations

New regulations have been a key driver for the decline in Chinese stocks over the past few months. However, for EH, I think regulation would actually be a positive tailwind for the company. The Chinese government has repeatedly promoted the development of eVTOL operations in national plans and EH has received multimillion-dollar collaboration agreements from cities such as Qingdao and Hezhou.

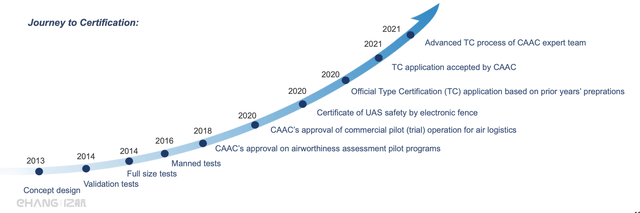

Source: EHang Q2 2021 presentation

After submitting the application in Jan 2021, the company is very close to achieving Type Certification for the EH216 from the CAAC and management expects this milestone to be achievable by late 2021 or early 2022. For reference, most US eVTOL companies don't expect to achieve Type Certification until late 2023 at the earliest.

I believe the regulatory process the EH216 has gone through will make it far more easier for the company to get Type Certification for the VT-30 as well and will also create a massive competitive advantage against other players who are trying to enter the Chinese market.

2021 results

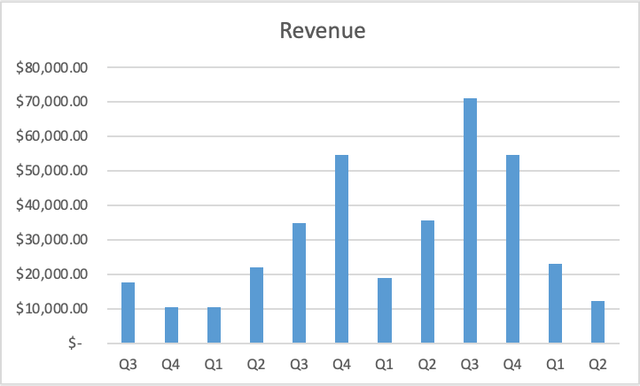

As EH diverts more resources into becoming a UAM platform company, the number of EH 216s sold has declined substantially, with just 3 units sold in Q2 2021 vs 15 units in Q1 2021. Naturally, this has led to a substantial YOY decline in revenue to just RMB 12mil in Q2 2021.

Interestingly, despite this massive strategy pivot, the company is guiding to generate RMB 94-144mil in H2 2021, representing a steep increase from Q2 2021 levels. I believe the ramp will come from both the 100 air mobility routes initiative as well as the ramp up in production for EHang's firefighting drones as the company has started operation of its Yunfu facility.

Source: WY Capital, EHang

With operating expenses remaining flat, EH is now generating operating losses of around RMB 70-80mil per quarter. Keep in mind that a good portion of this is stock-based compensation, and taking that out would bring FCF to around negative RMB 70mil for H1 2020.

EH currently has RMB 400mil in cash and short-term investments on its balance sheet which according to management should allow the company to operate for another 12-24 months while the business transitions towards being a platform provider.

Valuation

In the past few months, quite a few eVTOL SPACs have come public. Any investor can now buy shares of Joby (JOBY), Lilium (LILM), and Archer (ACHR), and there are still a few more eVTOL SPACs with pending mergers.

Surprisingly, most of these companies have done very well on the public markets despite an incredibly weak deSPAC market. Keep in mind that these are companies that won't generate revenues until 2024 at the earliest, yet even the cheapest of these companies, Vertical Aerospace, has a market cap of nearly $2bil.

In comparison, EH currently has a market cap of just $1.1bil despite the fact it is further along in both the regulatory and commercial phases. It is hard to pinpoint an exact valuation, but if EH trades at a $2bil valuation, it should be worth $36 per share, representing upside of 70%.

Takeaway

Overall, interest in the eVTOL space is heating up, yet poor sentiment amongst Chinese stocks as well as a sudden strategy change have pushed EH down substantially. If the company executes its 100 routes plan successfully, revenues will quickly return back to normal and substantial shareholder value will be created.

沒有留言:

張貼留言