Having already produced an 18% annual return from hydropower, BEP is ready to continue double digit growth with its transition to solar power.

BEP's project backlog is sufficient to double current production, while a solid balance sheet and investment grade rating ensure financing.

BEP affirmed its five-year plan calling for 12%-15% annual growth during its Analyst Day, which is likely conservative given its growth prospects.

With the world still in the early stages of the energy transition, BEP offers an opportunity to participate in the growth, benefiting from growing returns and distributions simultaneously.

Investment Thesis

Since its inception, renewable energy company Brookfield Renewable (BEP) has delivered impressive returns powered by hydro power. As it transitions to solar-fueled power, the company is well positioned to continue this trend, with a project backlog set to double current production. At its analyst day, BEP affirmed its 12 - 15% annual growth forecast through 2025, which I believe is conservative given its historical returns and future growth prospects. With the world still in the early stages of an energy transition, BEP offers its investors a unique chance to participate in the decarbonization, all the while providing steadily growing returns and shareholder distributions.

Company Overview

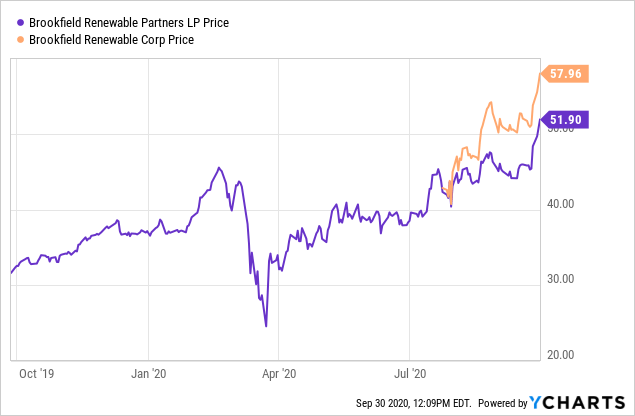

Brookfield Renewable is, as the name implies, a renewable energy company focused on hydro, solar and wind fueled power generation. With a 19 GW asset portfolio and an 18 GW project backlog, it is one of the largest pure play renewable energy producers in the world. Brookfield trades under two tickers: BEP - a limited partnership, and BEPC - a newly formed Canadian corporation. While both offer a stake in the same company and pay a similar dividend, variances in tax treatment result in differing prices and dividend yields.

Analyst Day Highlights

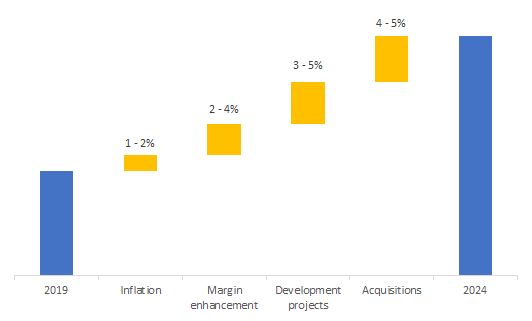

Brookfield hosted an Analyst Day last week, affirming its plan to grow organic cash flows by 6 - 11% through 2025. Acquisitions should add another 4 -5% (up from its previous estimate of 3 - 5%), equating to a 17% annual return at midpoint. Compared to its recent performance, I believe that this forecast is conservative - in its most recent quarter, Brookfield has grown cash flows by 19% year-over-year despite an 11% drop in total generation due to seasonal weakness in the hydro market.

The company's acquisition forecast assumes an average borrowing cost of 5%, down from its prior 5.5% estimate, which should come down further to BEP's current interest rate of 4% on long-term debt. If anything, the low interest rate environment should only push borrowing costs lower in the coming years.

Source: Brookfield Renewable Partners

While its future cash flow growth is promising, the company's ambitious capex program - BEP plans to spend $4B between 2020 and 2024 - is also dependent on healthy sales proceeds. Brookfield has what is called a capital recycling strategy by continuously selling non-core lower-profit assets and using the proceeds to buy or develop new projects. Thus, it is essential for management to stay on the ball overseeing asset sales and new development, particularly in the increasingly popular solar sector. Further, finding new profitable acquisition opportunities is likely to be a challenge in the coming future, and overpaying for assets is an investment risk that investors should be cognizant of.

Solar to Drive Future Growth

Source: Pixabay

Since its inception, BEP generated an average annual return of 18%. This rapid growth might seem difficult to replicate going forward, but Brookfield intends to do just that - utilizing cash flows from its substantial hydropower portfolio to ramp up solar-powered generation.

BEP has solar capacity of 2,600 MWs (compared to 7,900 MWs of hydro), with another 10,000 MWs in various stages of development. During its Q2 earnings call CEO Sachin Shah projected solar will be the "primary source of Brookfield's electricity generation in ten years." To aid this, the company recently made two acquisitions:

- Fully merged with Terraform (BEP already had a stake), which enhanced its position in Europe and North America and provided a foothold in India and China

- Bought a 1,200 MW solar project in Brazil, which is projected online in 2023 on the back of a $200M investment.

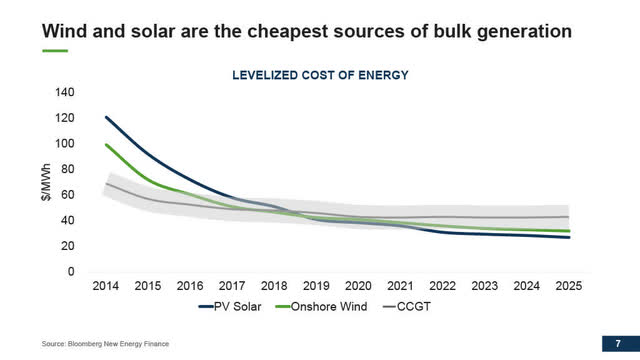

Driving

this shift to solar is a precipitous decline in costs - BEP estimates

that costs declined by about 2/3 over the past 5 years, with more

depreciation still to come. Outside of the EU and US, renewables are in

even earlier stages of development, hence the aforementioned cost

depreciation has yet to be fully realized. Projects located in emerging

markets (like Brazil or India) also benefit from cheaper labor and

construction costs, further boosting returns. Given its international

portfolio, especially in emerging markets (e.g., Brazil), I believe BEP

is one of the best positioned companies in the space to take advantage

of this trend.  Source: Brookfield Renewable 2020 Analyst Day

Source: Brookfield Renewable 2020 Analyst Day

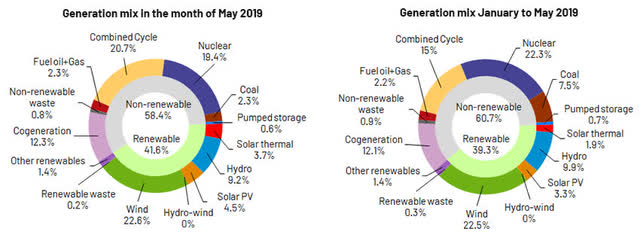

Despite the positive publicity and favorable valuation, solar remains mostly unexploited - just 1% of global electricity generation comes from harvesting sunlight. Even a country like Spain (where BEP has a 50% stake in X-Elio), which is at the forefront of the shift toward clean energy, gets just 4.5% of its electricity from solar, despite averaging 320 days of sunlight per year. This is bound to change very quickly though, as evident by the rapid growth in solar PV and solar thermal even since the beginning of this year.

Spain Electricity Generation by Source:

Source: Red Electrica de Espana

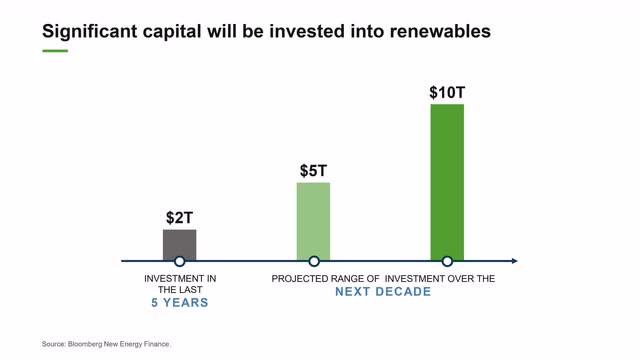

Brookfield expects investment into solar projects to at least double in the next decade as more countries and companies make to switch to the now economic and reliable energy source. As one of the leaders in renewables, I believe BEP has many opportunities to expand even beyond the 10,000 MWs already in the backlog, to maintain its double-digit growth for many years to come.

Source: Brookfield Renewable 2020 Analyst Day Presentation

Another positive trend in the solar market I believe has yet to be fully reflected in BEP's valuation is the impact that the technological improvements have on asset life. Soar assets are currently assumed to have useful lives of 15-20 years (this is used to calculate financing and depreciation costs). Meanwhile, the more established hydropower assets' lives are more or less perpetual, requiring only part replacements every 40 years. Recently, solar has been trending in the direction of hydro, which in turn, should lower financing costs and drive up the value and cash flow for BEP's solar assets.

More Upside from Hydropower

Source: Paxabay

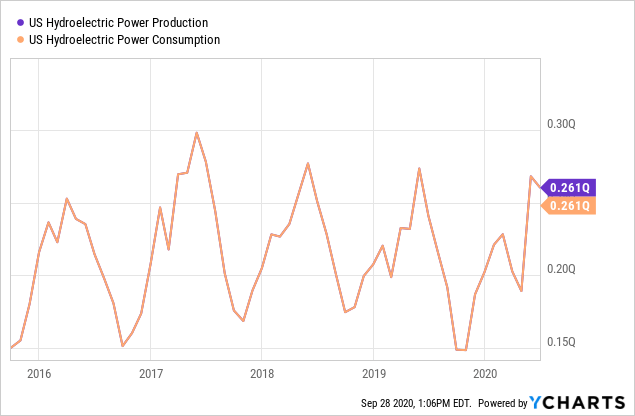

While solar is expected to drive long-term returns, hydro (which accounts for ¾ of BEP's current power generation) is likely to provide a short-term bump. Hydropower generation is highly cyclical - summer weakness follows rising production in the winter. This seasonality was already reflected in Q2, when weak hydro prices had Brookfield focus on short-term contracts. However, as we approach the winter, this trend should reverse, adding upside optionality to unit price. Meanwhile, hydro assets are essentially perpetual in their nature, requiring only component replacement every 40 or so years. Thus, BEP's hydro portfolio provides a stream of cash flows that requires minimal capex, leaving cash for growth elsewhere.

Financials

BEP sells most of its power via long-term Power Purchase Agreements (PPAs) that provide a steady cash flow stream. This year, 95% of its power is secured. Its counterparty risk is alleviated by its 600+ counterparties and strong demand for renewable power. The balance sheet looks solid as well - $3.4B of liquidity compared to $2.1B of corporate debt (BEP has $8.8B of debt on the project level backed by specific projects) and no material debt maturities in the next 5 years. I believe the downturn is a positive for Brookfield, giving a chance to outshine worse-off competitors and potentially lower its borrowing costs from 4% in the ultra-low interest rate environment.

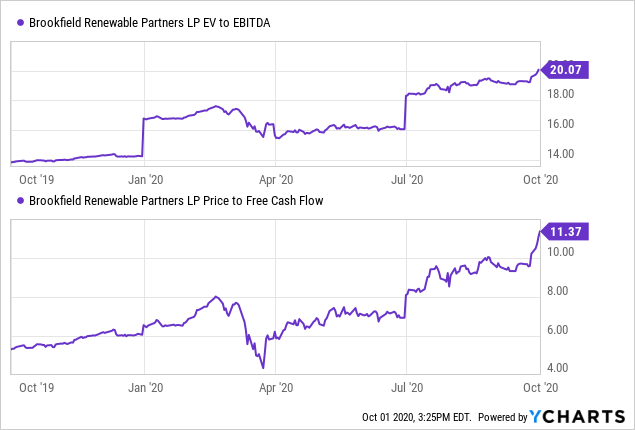

Investors have taken notice of BEP and the stock is by no means cheap: Its EV/EBITDA of 20x is on the high range of its 5-year historical average, as is its P/CF ratio of 11.4x. However, EV is expected to be large for a company that has been using debt to acquire projects as BEP has been doing. Its plan for the future is to reduce its reliance on debt to just $800M of new bonds to cover its $4B 5-year budget. Meanwhile, continued growth with the addition of new projects should drive EBITDA and CFs higher.

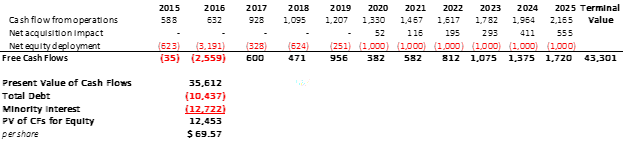

Below I calculate the intrinsic value for BEP based on the company's projected cash flow figures. I assume 10% organic growth, with net acquisitions adding another 4%. On the capex side, I assume $1B of net spend per year, which is on the high end of guidance of $800M - $1B. The resulting NPV of $70/unit implies an upside of ~30% based on the stock's closing price of $52/unit. Add to this a healthy 4% dividend yield, which Brookfield expects to grow by 5-9% per year, and the stock presents a valuable long-term investment despite its seemingly high relative valuation.

Source: Brookfield Renewable, Author Calculations

Summary

In conclusion, BEP offers consistently growing returns and distributions along with the opportunity to partake in a material energy transition still in its infancy. As solar fueled power generation picks up steam, Brookfield's potential is limitless. With significant expertise in the space, a solid asset base and backlog, and a stable financial position, investors will get what they pay for - a quality company in a rapidly growing industry.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

沒有留言:

張貼留言