https://seekingalpha.com/article/4397629-arkg-dont-always-follow-leader

Summary

- Some of the best performing ETFs in recent years come from ARK Invest, which solely focuses on thematic disruptive tech. ARK Genomic Revolution was their best performer of 2020.

- ARK's CIO, Cathie Wood, is perhaps most famous for her $4,000 [pre-split] price target on Tesla. To almost everyone's surprise, it has just about come to fruition.

- Hoping to hitch a ride on the next Tesla, investors have gravitated to ARK Invest ETFs, as well as their individual holdings.

- This has led to share price distortions, particularly in the small and mid cap companies held by ARK Genomic Revolution.

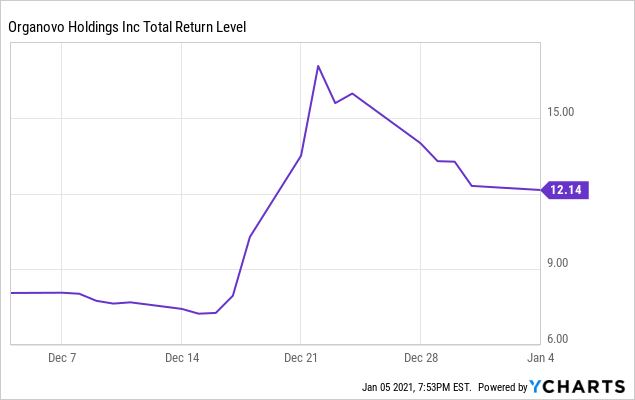

- The most glaring example of this is Organovo. Despite ceasing operations in 2019, the stock has rocketed higher because of the ARK effect.

近年來,一些表現最佳的ETF來自ARK Invest,該公司僅專注於主題破壞性技術。 ARK Genomic Revolution是2020年表現最好的產品。

ARK的首席信息官凱西·伍德(Cathie Wood)可能最出名的是她在特斯拉的目標價格(4,000美元)。幾乎每個人都感到驚訝,它即將實現。

希望搭上下一輛特斯拉,投資者傾向於ARK Invest ETF及其個人持股。 這導致了股價扭曲,特別是在ARK Genomic Revolution持有的中小型公司中。 最明顯的例子是Organovo。儘管2019年業務停止,但由於ARK效應,該股飆升。

Investment thesis

While there’s no denying ARK’s stock-picking acumen of recent years, you should not buy their ETFs or individual holdings blindly. The hype surrounding them has led to some irrational pricing, particularly in the smaller companies which they own a high percentage of. This is most evident with ARK Genomic Revolution Multi-Sector ETF (ARKG). While buying this ETF today should reward you in the long run, patient and prudent investors may want to wait for a better entry.

投資論文

儘管不可否認ARK近年來的選股敏銳性,但您不應盲目購買其ETF或個人持股。他們周圍的炒作導致一些不合理的定價,特別是在他們擁有較高百分比的較小公司中。這一點在ARK Genomic Revolution多部門ETF(ARKG)中最為明顯。從長遠來看,今天購買此ETF應該會獎勵您,但耐心和謹慎的投資者可能希望等待更好的入場券。

ARK may have a cult following, but it's deserved

Cathie Wood, photo credit: Forbes

Cathie Wood, photo credit: Forbes

Among the big name money managers, Cathie Wood of ARK Invest is arguably the most popular at this moment. Or at least, that’s what it seems like based on the opinions of millennial investors on Reddit, YouTube, and so forth. Many are dubbing her "the next Warren Buffett" which perhaps might be, but it's premature to say.

在大名鼎鼎的資金管理公司中,ARK Invest的Cathie Wood無疑是目前最受歡迎的。至少,這是基於千禧一代在Reddit,YouTube等上的投資者的意見所呈現的。許多人都在戲稱她為“下一個沃倫·巴菲特”,但這也許還為時過早。

ARK has only been offering actively managed investment products since 2014. Since they only invest in thematic, big growth disruptive ideas (various tech themes), it’s no surprise they have done exceptionally well these past six years. Only time will tell how ARK’s performance will fare over a multi-decade, multi-cycle horizon.

自2014年以來,ARK一直只提供積極管理的投資產品。由於他們只投資於具有主題意義的,具有重大增長破壞性的想法(各種技術主題),因此過去六年來他們的出色表現也就不足為奇了。只有時間才能證明ARK在數十年,多周期的視野中的表現如何。

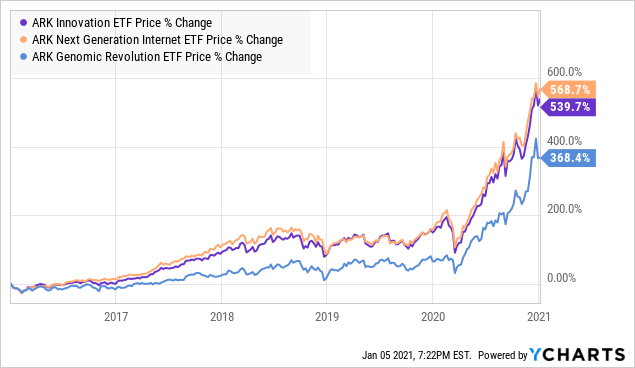

Regardless of ARK’s somewhat short stint, you can’t argue with the fact that they’ve trounced almost every ETF and mutual fund peer. Their best performer of 2020 was ARK Genomic Revolution, which returned a whopping 178%. ARK Next Generation Internet ETF (ARKW) gave 154%. ARK Innovation ETF (ARKK) has been one of the 100 most popular stocks on Robinhood, but I’m far more interested in the fact that this Morningstar 5-star ETF returned 153% in 2020, which is 3x its category average.

不論ARK的任職時間短短如何,您都無法否認它們幾乎擊敗了所有ETF和共同基金同行。他們在2020年表現最好的是ARK Genomic Revolution,獲得了高達178%的回報。 ARK下一代互聯網ETF(ARKW)給出154%。 ARK Innovation ETF(ARKK)一直是Robinhood上100只最受歡迎的股票之一,但我對此更感興趣,因為該晨星5星級ETF在2020年的回報率為153%,是同類平均水平的3倍。

The superstar responsible for ARK’s success, Cathie Wood, is probably most famous for her $4,000 call on Tesla (TSLA) in 2018. At the time, the price was $333 (before the 5 for 1 split). Tesla has almost hit her target in just two years ($3,675 currently, when split adjusted).

負責ARK成功的超級巨星凱西·伍德(Cathie Wood)可能最出名的是她在2018年以4,000美元的價格致電特斯拉(TSLA)。當時的價格為333美元(之前是1的5分)。特斯拉在短短兩年內就幾乎達到了她的目標(目前,分拆調整後為3,675美元)。

Given Wood’s shocking – yet accurate – call on Tesla, it’s understandable why investors have flocked to ARKG in recent months. Ironically, out of three aforementioned ETFs, this is the only one which does not hold Tesla. While she didn’t exactly call genomics the next Tesla (as many YouTube videos falsely suggest), she has gone on record countless times saying that she believes "the next FANG [stocks] are in the genomic age."

考慮到伍德令人震驚而又準確的呼籲特斯拉,這是可以理解的,為什麼投資者最近幾個月蜂擁至ARKG。具有諷刺意味的是,在上述三種ETF中,這是唯一沒有持有特斯拉的ETF。儘管她並沒有將基因組學確切地稱為下一個特斯拉(正如許多YouTube視頻錯誤地暗示的那樣),但她無數次記錄,說她相信“下一個FANG [股票]處於基因組時代。”

What ARKG holds

As the name suggest, this fund focuses on companies advancing genomics to benefit health. They specifically call out these six themes:

- CRISPR

- Targeted therapeutics

- Bioinformatics

- Molecular diagnostics

- Stem cells

- Agricultural biology

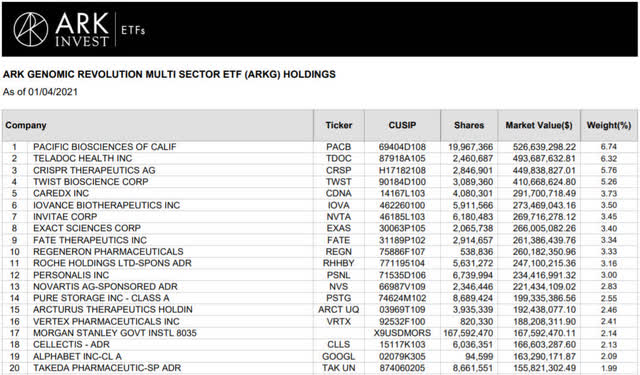

Here's a look at their top 20 holdings:

Many of the companies in the fund generate little to no revenue. For those developing therapies, many do not have any approved treatments on the market. For example their #3 holding is CRISPR Therapeutics (CRSP), a gene editing company with a $12B market cap, despite being years away from having any approved treatments.

On the flip side, many of the holdings are mature companies generating plenty of revenue, such as Regeneron (REGN), Roche (OTCQX:RHHBY), Novartis (NVS), Vertex (VRTX), and obviously Alphabet (GOOGL) (NASDAQ:GOOG).

Some may not be generating a great deal of revenue yet; however, they have a clear path to do so since they're not developing treatments which hinge on clinical trials. Their top holding, Pacific Biosciences of California (PACB), is one such example – they do genomic analysis.

基金中的許多公司幾乎沒有產生任何收入。對於那些正在開發療法的人,許多人在市場上沒有任何經過批准的療法。例如,他們排名第三的是CRISPR Therapeutics(CRSP),這是一家基因編輯公司,市值$ 12B,儘管距離獲得任何認可的治療方法還有數年之遙。

另一方面,許多持股都是成熟的公司,產生大量收入,例如Regeneron(REGN),Roche(OTCQX:RHHBY),Novartis(NVS),Vertex(VRTX)以及顯然的Alphabet(GOOGL)(NASDAQ: GOOG)。

有些可能尚未產生大量收入。但是,由於他們沒有開發取決於臨床試驗的治療方法,因此他們有一條明確的道路。他們的頭號人物,加利福尼亞太平洋生物科學(PACB),就是一個這樣的例子-他們進行基因組分析。

Should you follow Cathie’s lead?

In short, yes. However, your decision to buy now vs. later should factor in how the massive recent inflows into ARKG are driving up the valuations of all companies in the ETF.

The most glaring example of this is Organovo Holdings (ONVO). I am highlighting this specific example because I know it better than any other in ARKG. When Organovo went public in 2012, with my warrants exercised, if I recall correctly, I was the largest individual shareholder after the CEO and founder. While I no longer hold stock in the company, as I sold my last remaining shares in 2020, I still keep tabs on them.

ARK didn't start buying Organovo until a few years after I was in it. Not only did they buy it for ARKG, but also for ARKK and their ARK Autonomous Technology & Robotics ETF (ARKQ).

您應該跟隨凱蒂的領導嗎?

簡而言之,是的。但是,您決定現在購買還是以後購買,應該考慮到最近流入ARKG的大量資金如何推動ETF中所有公司的估值。

最明顯的例子是Organovo Holdings(ONVO)。我重點介紹此特定示例,因為我比ARKG中的任何其他示例都了解得更多。當Organovo在2012年公開發行股票並行使認股權證時,如果我沒記錯的話,我是僅次於CEO和創始人的最大個人股東。雖然我不再持有該公司的股票,但當我在2020年出售最後剩下的股票時,我仍然保持關注。

直到我加入ARK幾年之後,ARK才開始購買Organovo。他們不僅為ARKG購買了它,還為ARKK及其ARK自主技術和機器人ETF(ARKQ)購買了它。

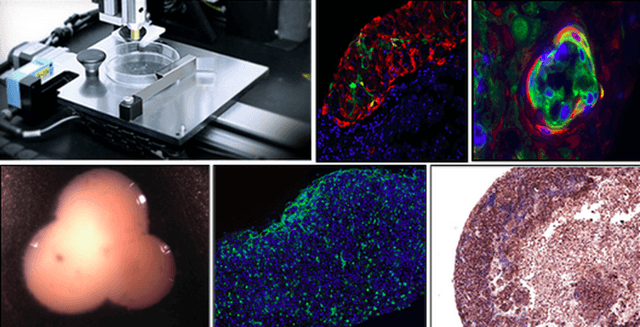

Organovo is a biotech 3-D printing company. Their R&D centered around the 3-D printing of human tissues. For example, blood vessels are made of vascular smooth muscle cells, endothelial cells, and fibroblasts. By 3-D printing these in the proper configuration, you can make a blood vessel, and yes, it really does work.

Efficacy aside, drug-induced liver injury is the number one reason that drugs fail in clinical trials. Organovo printed mini human "livers" to test compounds for pharma companies. L'Oreal hired them to bioprint living human skin for testing. Organovo's longer term goal was tissue and organic replacement – e.g. printing a liver patch to augment someone’s failing liver.

Organovo是一家生物技術3D打印公司。他們的研發圍繞人體組織的3D打印。例如,血管由血管平滑肌細胞,內皮細胞和成纖維細胞製成。通過以適當的配置進行3D打印,您可以製造血管,是的,它確實起作用。

除了功效,藥物誘發的肝損傷是藥物在臨床試驗中失敗的首要原因。 Organovo印刷了微型人類“肝臟”以測試製藥公司的化合物。歐萊雅聘請他們對人體皮膚進行生物打印以進行測試。 Organovo的長期目標是組織和有機物的替代-例如打印肝臟補丁以增強某人的肝衰竭。

Indeed, Organovo fit ARK’s theme of being a big and disruptive technology. Unfortunately, things did not go as planned.

In their early days, they did actually generate a few million in annual revenue with their drug development testing services. Then they kind of put the cart before the horse; growing the company fast, without growing sales to coincide. Naturally, this led to an ever growing cash burn and continued dilution via stock sales.

However, credit where credit is due, management did not spend all the money and bankrupt the company. Rather, they admitted their business plan wasn’t working as anticipated. In August 2019, they decided to basically cease operations and put themselves up for sale.

At that time, they had about $30 million in cash. Their liabilities were a few million, primarily consisting of a lease on an office and facility in San Diego. Their patent portfolio and IP, although unique, was not really what others valued. It was their cash-in-hand and the fact that they were a Nasdaq listed company which made them an attractive target.

的確,Organovo符合ARK的主題,即成為一項大型且具有破壞性的技術。不幸的是,事情沒有按計劃進行。

在成立之初,他們通過藥物開發測試服務確實創造了幾百萬美元的年收入。然後他們把馬車放在馬的前面。迅速發展公司,而銷售卻沒有同步增長。自然,這導致現金消耗不斷增加,並通過股票銷售不斷稀釋。

但是,在應得信貸的情況下,管理層並未花光所有金錢並使公司破產。相反,他們承認自己的商業計劃沒有按預期進行。在2019年8月,他們決定基本停止運營並將自己出售。

當時,他們有大約3000萬美元現金。他們的債務為數百萬美元,主要包括在聖地亞哥的辦公室和設施的租賃。他們的專利組合和IP儘管是獨一無二的,但並不是別人真正看重的。這是他們的現金,也是他們在納斯達克上市的公司,這使他們成為了有吸引力的目標。

In other words, they weren’t really being sold for their technology. Rather, it was primarily as a reverse merger candidate.

Tarveda Therapeutics tried to reverse-merge with them to take themselves public. Apparently, they didn’t even have any intention of using Organovo’s bioprinting technology. Their cancer therapy had nothing to do with it.

This led to a drawn out tiff between the former CEO and Founder of Organovo, Keith Murphy. He had left the company in 2017. He too had submitted a proposal for his privately held Viscient Biosciences to merge with Organovo, which the Board of Directors did not choose. As with Tarveda, the big prize was the cash and Nasdaq listing. However unlike Tarveda, Viscient would also make use of the technology. Murphy rallied shareholders to reject the Tarveda deal and go with his.

換句話說,他們並沒有真正因為技術而被出售。相反,它主要是作為反向合併候選人。

Tarveda Therapeutics試圖與他們反向合併,以使自己公開。顯然,他們甚至沒有打算使用Organovo的生物打印技術。他們的癌症療法與此無關。

這導致了Organovo的前首席執行官與創始人Keith Murphy之間的拉鋸戰。他於2017年離開公司。他也已經提交了關於將其私人擁有的Viscient Biosciences與Organovo合併的提案,董事會沒有選擇。與Tarveda一樣,大獎是現金和在納斯達克上市。但是,與Tarveda不同,Viscient還將利用該技術。墨菲(Murphy)召集股東們拒絕塔維達(Tarveda)的交易,並與其達成一致。

It would take an entire season of The Young and the Restless to document all this drama. To sum up the ending, after three years of being gone, Murphy is now back as the company’s Executive Chairman and Principal Executive Officer. He also got to appoint board and advisory nominees. Yet the state of the company remains the same; they currently do not have active operations and are in transition.

要記錄所有這部戲,要花整個一季的《年輕與躁動》。總而言之,經過三年的努力,墨菲現在又回到了公司的執行董事長兼首席執行官的位置。他還必須任命董事會和顧問候選人。但是公司的狀態保持不變。他們目前沒有有效的操作,並且正在過渡中。

How ARK moves ONVO’s share price

Despite the fact that Organovo is currently without operations, the share price has gyrated immensely – mostly upward – these past few months. This has been driven by inflows into ARK funds. They must buy more ONVO stock in a proportionate manner, to keep the weighting.

儘管Organovo目前沒有運營,但在過去的幾個月中,股價一直在大幅迴旋-大多數是上漲。這是由ARK資金流入所驅動的。他們必須按比例購買更多ONVO股票,以保持權重。

Data by YCharts

Data by YChartsFor companies which are several billion or more in market cap, this has less of an effect on share price. For a tiny microcap like Organovo, this forced buying can really move the share price.

As of their most recent 13F/13D/G filing, ARK owned 1,422,394 shares across their funds. Since there are only 6.37M shares outstanding, that’s about 22% of the company. Keep in mind that’s not the float. When you subtract out the shares which aren’t being traded (e.g. insider and institutional holdings), the buying done by ARK is really moving the needle.

To compound this effect, you have all the copycats. Traders who are buying ONVO because they see ARK buying it.

對於市值超過數十億美元的公司,這對股價的影響較小。對於像Organovo這樣的微型股票,這種強行買入確實可以改變股價。

截至他們最近的13F / 13D / G文件,ARK擁有1,422,394股股票。由於只有637萬股流通在外股票,約占公司股份的22%。請記住,這不是浮動的。當您減去未交易的股票(例如內幕人士和機構持股)時,ARK的購買實際上在推動這一步。

為了使這種效果更加複雜,您擁有了所有的模仿者。購買ONVO的交易商是因為他們看到ARK會購買它。

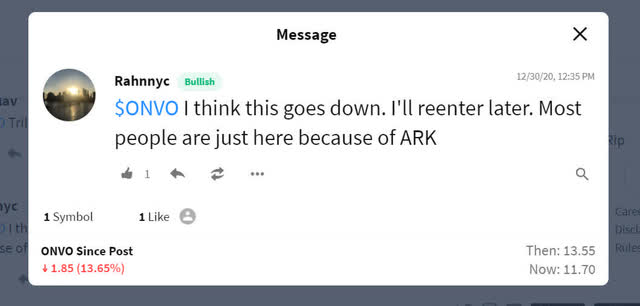

I'm not sure who the above person is on StockTwits, but his last sentence I'm in agreement with. Last quarter, you would regularly see high percentage one-day gains in ONVO, in concert with ARKG moving up.

I won’t feature specific examples here, as to not embarrass strangers, but if you want to peruse StockTwits, Reddit, and YouTube videos, you will see how retail investors have been gobbling up ONVO, oblivious to the fact that the company had ceased operations and that actually, ARK has been decreasing – not increasing – their weighting. They don't get that ARKG had bought more in 2020 to keep up with inflows, while simultaneously reducing their weighting (and substantially at that). In fact, it’s their tiniest holding at just 0.06% as of January 4, 2020.

我不確定上述人員是誰在StockTwits上,但是我同意他的最後一句話。上個季度,隨著ARKG的增長,您經常會看到ONVO的一日收益率很高。

我不會在這裡展示具體示例,以免使陌生人感到尷尬,但是,如果您想細讀StockTwits,Reddit和YouTube視頻,您將看到散戶投資者如何吞併ONVO,而忽略了該公司已經停止營業的事實實際上,ARK一直在減少而不是增加其比重。他們不知道ARKG在2020年購買了更多資金來跟上資金流入的步伐,同時又降低了權重(並以此為基礎)。實際上,截至2020年1月4日,這是他們最小的持倉量,僅為0.06%。

A self-fulfilling prophecy

In some ways, many of the names in ARKG are a self-fulfilling prophecy. The majority are small and mid caps. Their share prices are winning lately, even if the companies themselves are not, largely because of ARK's influence on them. Something I call "The ARK effect." This effect can work, until it doesn't.

For those who look at ARKG's holdings and then buy the individual names, be aware that the valuations on many are quite stretched, due to massive inflows as of recently.

To be clear, I am a fan of many of their holdings. It's just that you have a decent chance of getting a better entry on many of these names later on. There will be secondary offerings. There will be moments they are not in vogue. For that reason, you also may have better opportunities for buying ARKG in the coming months.

在某些方面,ARKG中的許多名稱都是一個自我實現的預言。多數是中小盤股。他們的股價最近在上漲,即使公司本身沒有贏,很大程度上是由於ARK對他們的影響。我稱之為“方舟效應”。此效果可以起作用,直到無效為止。 對於那些先查看ARKG持股然後購買各個名稱的人,請注意,由於最近大量資金流入,許多股票的估值都相當高。 需要明確的是,我是他們許多資產的粉絲。只是您以後有很多機會可以更好地進入這些名稱中。將有輔助產品。有時他們不會流行。因此,在接下來的幾個月中,您可能還會有更多的機會購買ARKG

I’m also seeing a lot of misunderstandings among ARK fans. For example, they hear Cathie Wood talk about CRISPR and assume that means she’s talking about CRISPR Therapeutics. Perhaps she is but more likely, she’s talking about CRISPR/Cas9 in general, a gene editing technology whose IP is owned by two other public companies as well (Editas (EDIT), Intellia (NTLA)). However, CRSP stock saw outsized gains these past several quarters because of, well, having the best branded company name! Myself and many others would actually argue Editas is on par, if not better.

As someone who has invested in biotech for nearly two decades, no matter how exciting a technology may seem, you also need to realize that a better mousetrap will come. It’s not a matter of if, but when.

With CRISPR, that has already happened to some extent. Not to say there isn’t a good chance of CRISPR treatments being approved for sickle cell and beta-thalassemia, among others. The question is, why would CRISPR continue to be used, when there are newer gene editing techniques which don’t cause double-strand breaks in DNA? Those cause mutations, a side effect definitely best avoided!

A large percentage of genetic diseases can be edited without double strand breaks, using newer methods. But if you fix them with CRISPR, you're doing the double breaks. The better mousetrap risk seems to be ignored right now, as it's all about buying CRSP and similar at any price, because ARKG owns it. Everyone wants the next Tesla!

The takeaway

Despite ARK’s phenomenal winning streak, you should not be blindly buying their holdings at any price. When it comes to ARKG, this is especially true since a greater percentage of its holdings are smaller companies, and therefore, they're even more influenced by the ARK effect. If you buy ARKG now, keep in mind that the elevated valuations for some of their holdings are largely due to the ARK effect.

在ARK粉絲中,我也看到了很多誤解。例如,他們聽到凱西·伍德(Cathie Wood)談論CRISPR,並認為那意味著她在談論CRISPR Therapeutics。也許她是,但更有可能的是,她通常在談論CRISPR / Cas9,這是一種基因編輯技術,其IP也由其他兩家上市公司擁有(Editas(EDIT),Intellia(NTLA))。但是,由於擁有最佳品牌公司名稱,CRSP的股票在過去幾個季度中獲得了巨大的收益!我本人和許多其他人實際上會爭辯說Editas是同等的,即使不是更好。

作為已經在生物技術領域投資了近二十年的人,無論一項技術看起來多麼令人興奮,您還需要意識到將會有更好的捕鼠器。這不是問題,而是何時。

對於CRISPR,這已經在某種程度上發生了。並不是說CRISPR治療被批准用於鐮狀細胞和β地中海貧血的可能性很小。問題是,當有新的基因編輯技術不引起DNA雙鏈斷裂時,為什麼會繼續使用CRISPR?這些會引起突變,絕對最好避免副作用!

使用更新的方法,可以編輯大部分遺傳疾病而無需雙鏈斷裂。但是,如果您使用CRISPR修復它們,那麼您將面臨兩次斷裂。更好的捕鼠器風險現在似乎被忽略了,因為這一切都是以任意價格購買CRSP和類似產品,因為ARKG擁有它。每個人都想要下一個特斯拉!

外賣

儘管ARK取得了驚人的連勝紀錄,但您不應盲目以任何價格購買他們的股份。對於ARKG來說,尤其如此,因為它持有的股份中有較大比例是較小的公司,因此,它們受到ARK效應的影響更大。如果您現在購買ARKG,請記住,他們所持股票的較高估值很大程度上是由於ARK效應所致。

Disclosure: I am/we are long EDIT, CRSP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

披露:我/我們長期編輯,CRSP。我自己寫這篇文章,表達了自己的見解。我沒有得到任何補償(除了尋求Alpha之外)。我與本文中提及其股票的任何公司都沒有業務關係。

沒有留言:

張貼留言