Brookfield Renewable Partners has performed incredibly well since we last recommended it.

The company represents an intelligent way to join the ESG movement, with its continued commitment to growing dividends.

Brookfield Renewable Partners has a unique number of growth opportunities to improve its FFO.

Brookfield Renewable Partners is a valuable long-term investment that should be a part of every portfolio.

I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Brookfield Renewable Partners (NYSE: BEP) is a publicly traded limit partnership that's gone up nearly 90% since we last recommended the company just over a year ago. The company has been a strong performer, watching its share price increase almost 70% YTD and making the company's dividend more than 3%. However, as we'll see throughout this article, the company has impressive and long-term assets with the potential to drive respectable rewards.

Brookfield Renewable Partners - Yahoo Finance

Brookfield Renewable Partners 3Q 2020 Results

Brookfield Renewable Partners has impressive 3Q 2020 results that highlight the company's strength and continued commitment.

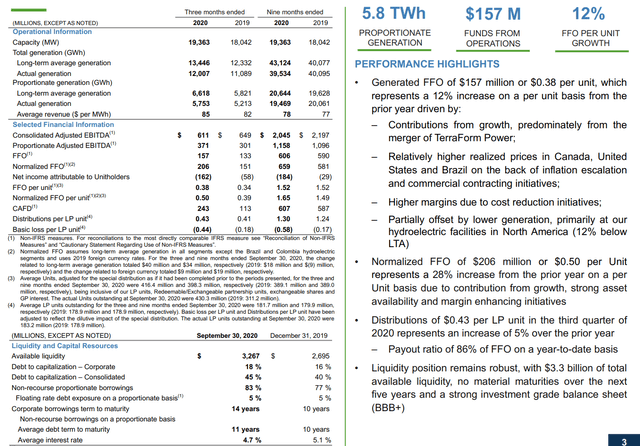

Brookfield Renewable Partners 3Q 2020 Results - Brookfield Renewable Partners Investor Presentation

Brookfield Renewable Partners had 5.8 TWh in proportionate generation, and $157 million in funds from operations, highlighting the company's strength. The company saw 12% FFO per unit growth, and it has significant capacity. The company saw a decline in proportionate long-term average generation, although for the 9 month period production remained stronger.

Given respectable strong average revenue of $77 / MWh, or $77 million / TWh, the company's revenue has remained and financials have remained strong. The company's FFO per unit, normalized, is nearly $1.6 / share annualized, a respectable yield versus the company's $60 share price. That highlights that the company is quite expensive currently, although in a low interest world its valuable.

More so, not only has the company continued to receive quality and valuable contracts, but its continued to grow FFO YoY.

Brookfield Renewable Partners Asset Overview

Overall, Brookfield Renewable Partners has impressive assets that'll continue to drive strong long-term cash flow for shareholders.

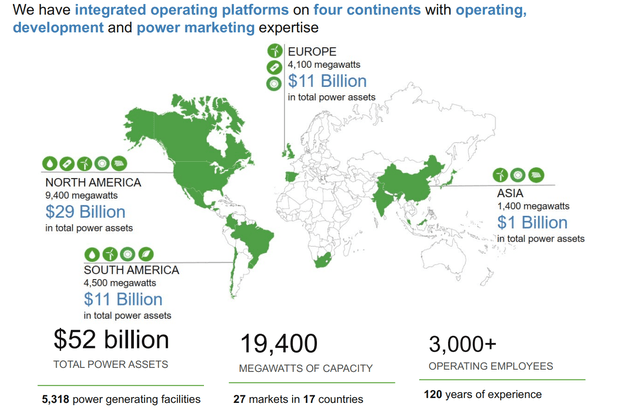

Brookfield Renewable Partners Assets - Brookfield Renewable Partners Investor Presentation

Brookfield Renewable Partners Assets - Brookfield Renewable Partners Investor Presentation

Brookfield Renewable Partners has a massive $52 billion in total power assets across 5138 power generating facilities spread across the world. The company's more than a century of assets comes with more than 100 years of experience, spread across 27 markets in 17 countries. The company has nearly 20 thousand megawatts of capacity.

The company's distributed portfolio of renewable assets come with multi-decade contracts, and their potential is increasingly popular, with the company having massive expansive potential. It's also worth noting that the company is primarily hydroelectric focus, but across its portfolio, its incredibly low cost assets ($0.077 / KWh) are competitive with all other forms of power.

That means that these assets, at low cost, are very high potential.

Brookfield Renewable Partners Growth Potential

The company has an exciting portfolio of development assets that will come out soon and have the potential to cause a near double-digit growth in FFO.

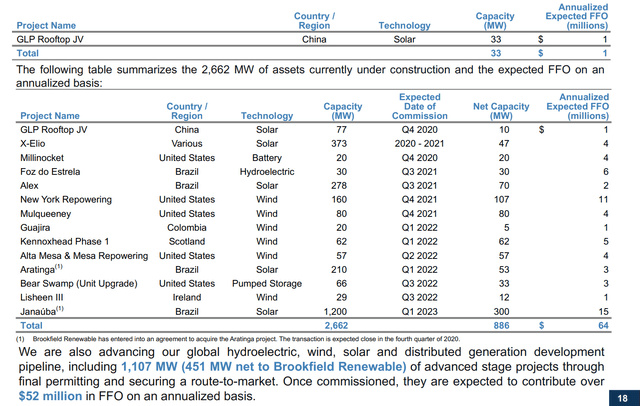

Brookfield Renewable Partners Growth - Brookfield Renewable Partners Investor Presentation

The company has 886 MW of net capacity projects it is focused on developing, in a variety of technologies like solar, wind, battery, hydroelectric etcetera. These projects are spread across the world, and the vast majority of the cash flow is expect to come by the end of 2021, with most of the rest by the end of 2022. A massive solar project will come in 1Q 2023.

The $65 million in annualized FFO from the projects is incredibly significant. Past that, the company is looking at longer term projects, including advanced stage projects through final permitting and a route-to-market. These projects will also come online soon in the coming years, providing an additional $51 million in FFO on an annualized basis.

As can be seen here, Brookfield Renewable Partners has an impressive asset base and a strong pathway to growth.

Brookfield Renewable Partners Shareholder Distributions

Brookfield Renewable Partners has an impressive pathway to growing shareholder distributions and rewards.

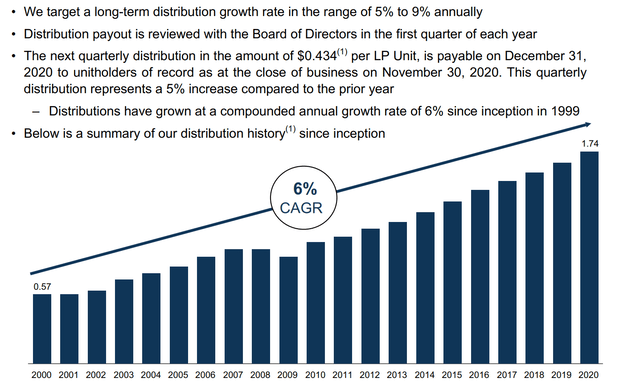

Brookfield Renewable Partners Dividend History - Brookfield Renewable Partners Investor Presentation

Brookfield Renewable Partners is targeting a long-term distribution growth rate in the range of 5 to 9% annualized. The company's distribution payout is reviewed annually and the next quarterly distribution is $0.434 per unit. The company's annualized growth rate, is roughly 10-12 years. The company's long history of growth is likely to continue.

We recommend investors look at Brookfield Renewable Partners as a valuable long-term investment. Those who invest now, at current growth levels, will see a dividend 4x the current level in 24 years. That's a ~13% yield on cost. If you're 40 now, and you invest $100 thousand today, you'll earn more than $1000 / month in retirement.

That's incredibly valuable and shows Brookfield Renewable Partner's strength.

Brookfield Renewable Partners Risk

Brookfield Renewable Partner's largest risk, in our view, isn't government funding into the renewable energy as you would believe. Renewable energy is already very cost effective with established sources of power, especially hydroelectric and wind power. Rather, we feel the company's largest risk is its share price, due to ESG investing.

We last discussed the company a year ago, at a price of less than $35 / share, and since then, its returned nearly than 90%. The company was staggeringly good of an opportunity at less than $40 / share, but its recent share price rise means that the company's yield has dropped significantly and its much less enticing.

Normally, a growth above historical valuation, is followed by a multiple contraction at some point, which can lead to significant share price drops, and in our view, is the company's largest risk.

Conclusion

Brookfield Renewable Partners has an impressive portfolio of assets. The company has continued to see strong power generation from its assets, and in the midst of the ESG movement, investors have clamored for the company's stock driving up its share price. This multiple expansion was driven by a low interest rate environment, and we don't see it as permanent.

However, despite that risk, the company's strong assets, continued path to asset growth, and commitment to shareholder rewards makes it a valuable long-tern investment opportunity. Those who invest today can get a double-digit yield in 25 years, making the company a valuable cash investment opportunity.

沒有留言:

張貼留言