Summary

HUYA continued defying expectations and continued growing quickly.

It announced exciting new growth initiatives and a strong outlook for Q4.

Valuation continues to be cheap for such a fast growing company.

After reporting Q3 results, HUYA (HUYA) has collapsed over 10% despite beating estimates handily. We believe this is due to macroeconomic fears surrounding China and isn't due to HUYA's fundamentals, which continue to be very strong. We believe that once conditions improve, HUYA's valuation should improve.

Source: google images

Q3 results

Q3 was a great quarter for HUYA. HUYA not only beat analyst estimates handily but also even beat our much higher revenue expectations substantially. It generated over 2.27 billion RMB of revenues vs. our 2.24 billion RMB expectations mentioned in our last article. It beat management's own expectations for the 6th quarter in a row, which shows just how excellent this management team is.

We expect HUYA to report $2240 million in revenues, slightly above the high end of its guidance range. As mentioned earlier, management has a good track record of beating its own targets, so we think this revenue target can be easily achieved by HUYA.Source: Previous article

Gross margins have also improved substantially to 17.94%, again beating our 17% estimate, allowing HUYA to make over 400 million RMB in gross profit. We think there is still substantial room to grow gross margins as HUYA continues to scale.

Operating margins were a bit lower than our expectations. Despite strong G&A leverage, S&M and R&D both increased substantially higher than revenues this quarter. However, since HUYA is a fast growing company, we wouldn't be too worried by rising expenses, as these expenses allow HUYA to continue to grow at incredible rates.

MAUs continue to grow strongly, with HUYA MAUs growing nearly 50% to 146 million. International MAUs also continued to grow strongly, with NIMO TV MAUs growing to 17 million, or up 13% sequentially. Monetization continues to grow at a rapid rate, with paying users growing 28.5% YOY.

Management continued to make progress on strategic initiatives, for example, revenue diversification. They have been very successful with the launch of their new advertising distribution platform, and this should help ad revenue growth substantially in the future. Ad revenue currently only makes up around 5% of revenue currently, though, so this could definitely be a strong growth driver in the future.

Diversifying our revenue stream has always been a mission of Huya's management team. As mentioned previously, the advertising distribution platform that we launched in August has been receiving positive feedback from our advertisers. Especially in game and advertising realm, nearly half of game advertisers with Huya have placed advertising orders through the platform.

Not only did HUYA report strong results today, but management continues to expect revenue to grow nearly 60% YOY in the 4th quarter.

For the fourth quarter of 2019, Huya currently expects total net revenues to be in the range of RMB2,340 million to RMB2,420 million, representing a year-over-year growth of between 55.5% and 60.8%. This forecast reflects our current and preliminary views on the market and operational conditions, which are subject to change.Source: Q3 2019 call

We think the growth outlook for HUYA continues to be very bright. esports is still in its early stages, and as it continues to grow very quickly, HUYA should benefit substantially as more and more people become fans of esports.

esports is not the only way HUYA can grow, though. Management unveiled an interesting growth initiative regarding publishing their own games this quarter.

In addition, as part of our preliminary attempt in game publishing business, we published a Remedy's action adventure game called Control in Southeast Asia, Hong Kong and Taiwan regions in this December. This is a case of exploring more opportunities in the upstream of gaming value chain.Source: Q3 2019 call

This is a really interesting move, and if it becomes successful, which we think is likely due to Tencent's (OTCPK:TCEHY) ownership of 40% of HUYA and HUYA's large base of viewers, it could drastically increase HUYA's value. HUYA would not only broadcast content but they would also own the content, giving them significant bargaining power over streamers.

Overall though, Q3 is just another massive step in HUYA's journey to becoming the largest global gaming livestreaming platform, which HUYA is approaching rapidly as it continues forming partnerships and attracting viewers.

Valuation

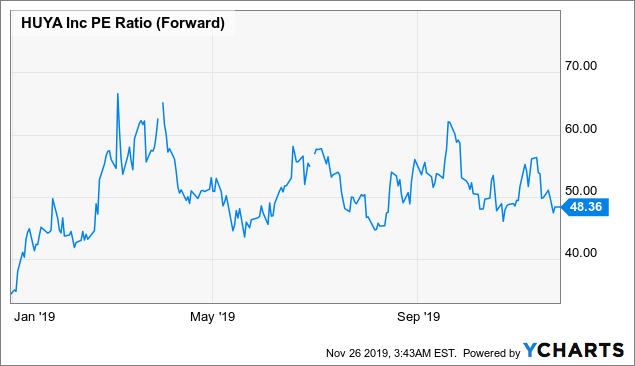

HUYA's valuation, while still high, has come down recently to below 50x forward PE. We believe this is more than fair and perhaps cheap as HUYA's growth runway continues to be extremely long and management continues to execute well, beating their own expectations time and time again.

Data by YCharts

Data by YCharts

Investors need to remember that in spite of a tough Chinese advertising market, HUYA is growing revenues nearly 80%. As for profits, while they may be small currently, when HUYA stops reinvesting for growth, profits should expand drastically and operating margins should go well past 20%.

Takeaway

Overall, we see the decline as an opportunity and believe that HUYA continues to be quite cheap for a company with great management and a long growth runway. We continue to own HUYA through YY (YY) and will hold for the long term as esports continues to grow around the world.

沒有留言:

張貼留言